401k calculator with over 50 catch up

For governmental 457b plans only. How to use 401k calculator.

Solo 401k Contribution Limits And Types

A 401 k can be one of your best tools for creating a secure retirement.

. 401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment returns from now until. My husband turned 50 in 2018. According to the IRS he can contribute 6000 for 401k catch up.

If you are 50 years of age or older and are already contributing the. We show you top results so you can stop searching and start finding the answers you need. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The annual elective deferral limit for a 401k plan in 2022 is 20500. If you already make the.

The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500. Catch-up contributions can help you do just that. First all contributions and earnings to your 401 k are tax deferred.

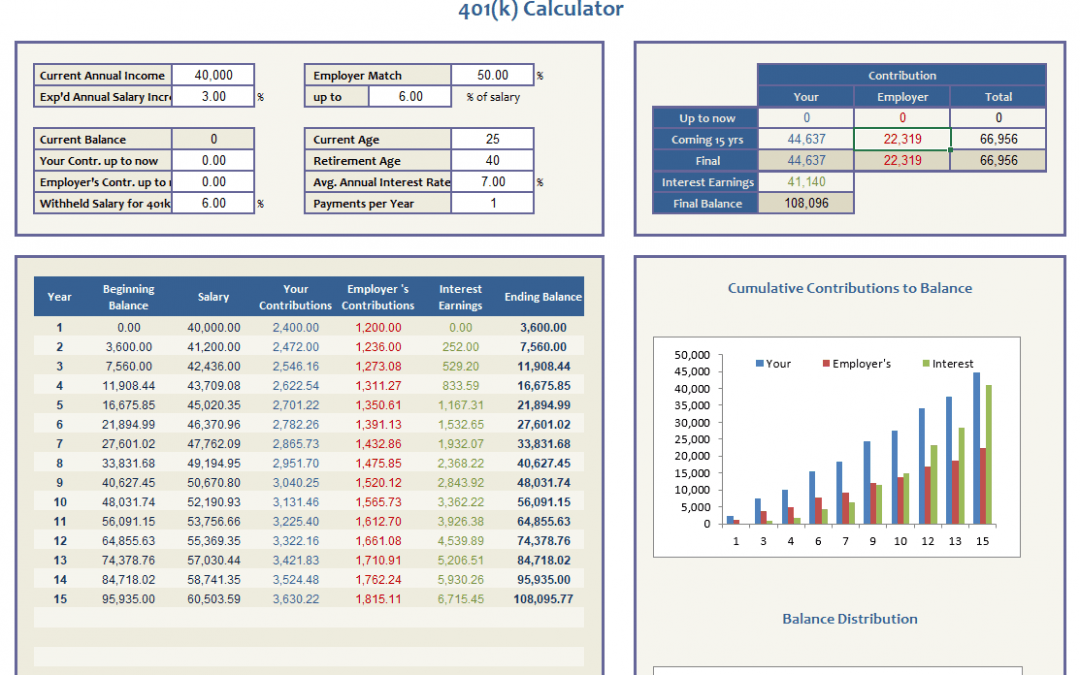

If you want to know how much you can put aside for retirement by investing your money over a period of time then our 401k Retirement Calculator can help. The maximum catch-up contribution available is 6500 for 2022. Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions.

Remember you have until April 15 2021 to contribute the maximum for 2020. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Deferral limits for 401k plans are 19500 in 2020.

The TurboTax software is saying he contributed over the 18500 but it is less than the 6000. The catch-up contribution limit for. Dont Wait To Get Started.

As you enter the information. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. In 2019 the additional annual contribution limit for 401k 403b most 457 plans and the federal governments Thrift Savings Plan will stay the same for employees age 50 or.

This means that if you are 50 or over you can contribute a total of 27000 per year. Ad Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. It provides you with two important advantages. TIAA Can Help You Create A Retirement Plan For Your Future.

Retirement Topics - Catch-Up Contributions. Ad Maximize Your Savings With These 401K Contribution Tips From AARP. 2022 There is an alternative limit for governmental 457b participants who are in one of.

The catch-up contribution for people age 50 and over remains the same additional 1000. Get to your destination by making sure your retirement tank is full. In 2022 this catch-up contribution is 6500 meaning that those 50 and older can contribute a maximum of 27000 to their 401 k for that year.

In tax years 2020 and 2021 those 50 and older can save an additional 1000 to their traditional or Roth IRA above and beyond the baseline 6000 annual limit for all eligible. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains 1000. Plan For the Retirement You Want With Tips and Tools From AARP.

For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500.

How Much Should I Have In My 401 K At 50

Retirement Services 401 K Calculator

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Bear Markets And Your 401 K

The Maximum 401k Contribution Limit Financial Samurai

401k Calculator

401 K Calculator Credit Karma

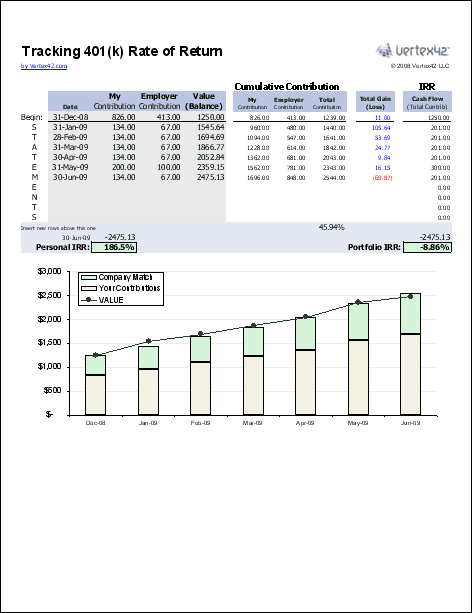

Free 401k Calculator For Excel Calculate Your 401k Savings

Irs Announces 2016 Retirement Plans Contribution Limits For 401 K S And More

401 K Calculator Simple 401 K Estimator At Retirement

401 K Calculator Mycalculators Com

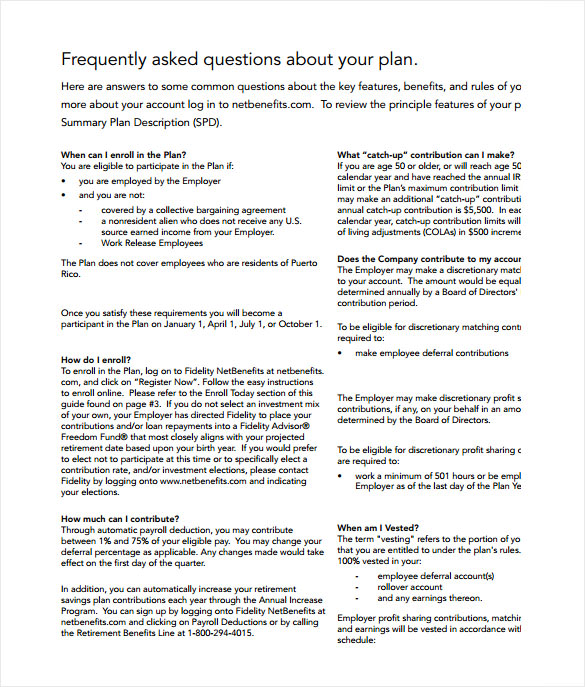

Free 6 Sample 401k Calculator Templates In Pdf

Excel 401 K Value Estimation Youtube

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Retirement Calculator With Save Your Raise Feature

Free 401k Calculator For Excel Calculate Your 401k Savings

Engano Editorial Pino 401k Growth Calculator Rubi Cesped Instantaneamente